Pehea e helu ai i ke dute Australian a me GST ke lawe mai ʻoe mai Kina a Australia?

Uku ʻia ke dute o Australian/GST i ka AU customs a i ʻole ke aupuni nāna e hoʻopuka i kahi invoice ma hope o kou hana ʻana i ka ʻae ʻana i nā dute Australia.

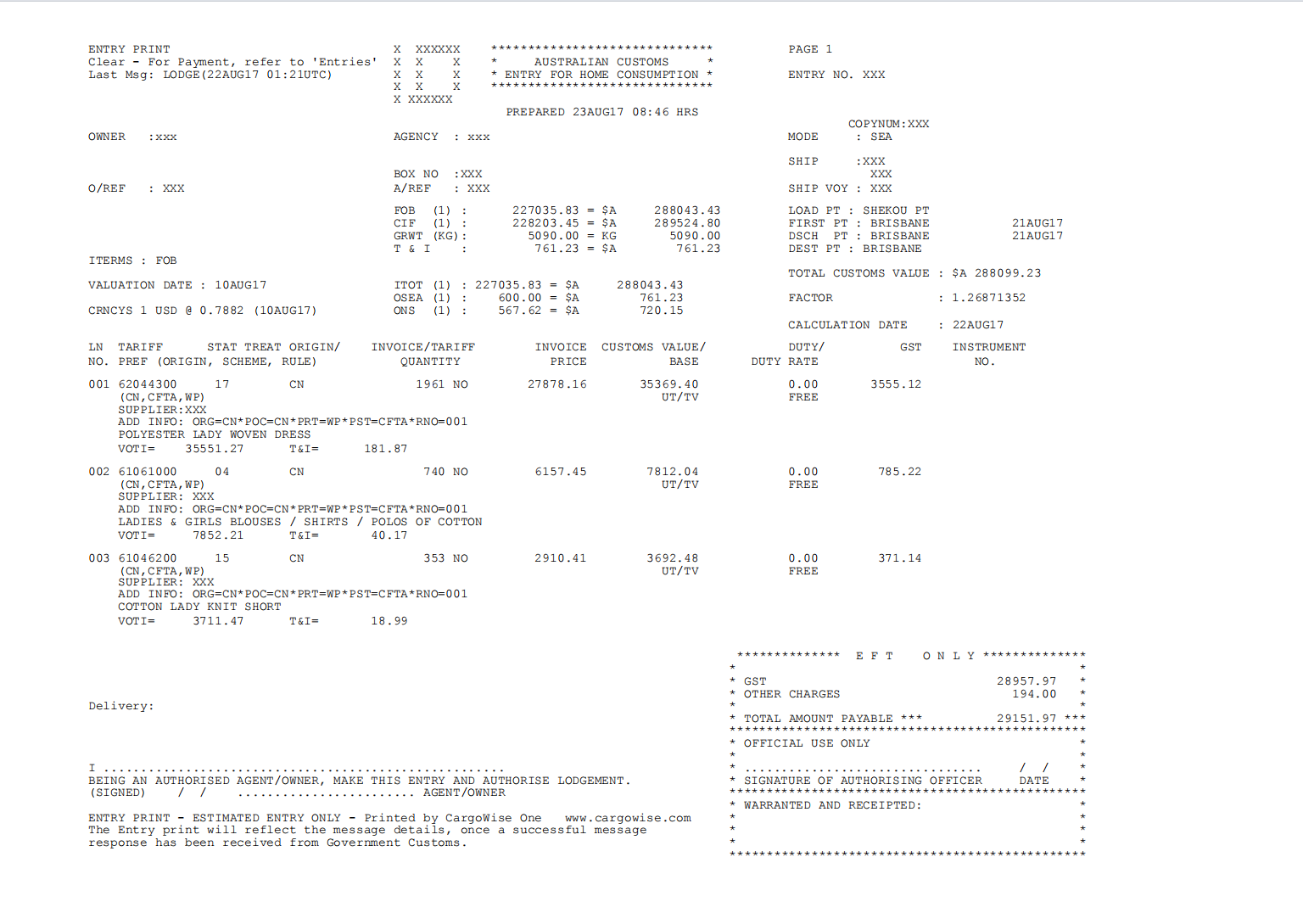

ʻEkolu mau ʻāpana ʻo ke duty/GST invoice o Australia, ʻo ia ke DUTY, GST a me ka ENTRY CHARGE.

1.Duty pili i ke ʻano o nā huahana.

Akā ʻoiai ua kau inoa ʻo Kina i kahi ʻaelike kālepa manuahi me Australia, inā hiki iā ʻoe ke hāʻawi i ka palapala FTA, ʻoi aku ma mua o 90% o nā huahana mai Kina ʻaʻohe dute. Ua kapa ʻia ka palapala FTA i ka palapala COO a hoʻohana ʻia e hōʻike i nā huahana i hana ʻia ma Kina.

2. ʻO GST ka hapa ʻelua e pono ai ʻoe e uku i nā kuʻuna AU ke lawe mai ʻoe mai Kina.

ʻO GST ka 10% o ka waiwai ukana i maʻalahi ke hoʻomaopopo

3. ʻO ka uku komo ʻo ia ke kolu o ka ʻāpana kūʻai ʻo AU a ua kapa ʻia ʻo ia e like me nā uku ʻē aʻe. E pili ana i ka waiwai ukana mai AUD50 a i AUD300.

Aia ma lalo iho kahi laʻana o ke dute/gst invoice o Australia i hoʻopuka ʻia e ka AU customs:

Eia naʻe, inā ʻoi aku ka liʻiliʻi o kāu waiwai ukana ma mua o AUD1000, hiki iā ʻoe ke noi no ka hana ʻole AU duty/gst. ʻAʻole e hoʻopuka nā kuʻuna o Australia i kahi invoice

For more information pls visit our website www.dakaintltransport.com or email us at robert_he@dakaintl.cn or telephone/wechat/whatsapp us at +86 15018521480

Ka manawa hoʻouna: Oct-24-2023